Banking Functions

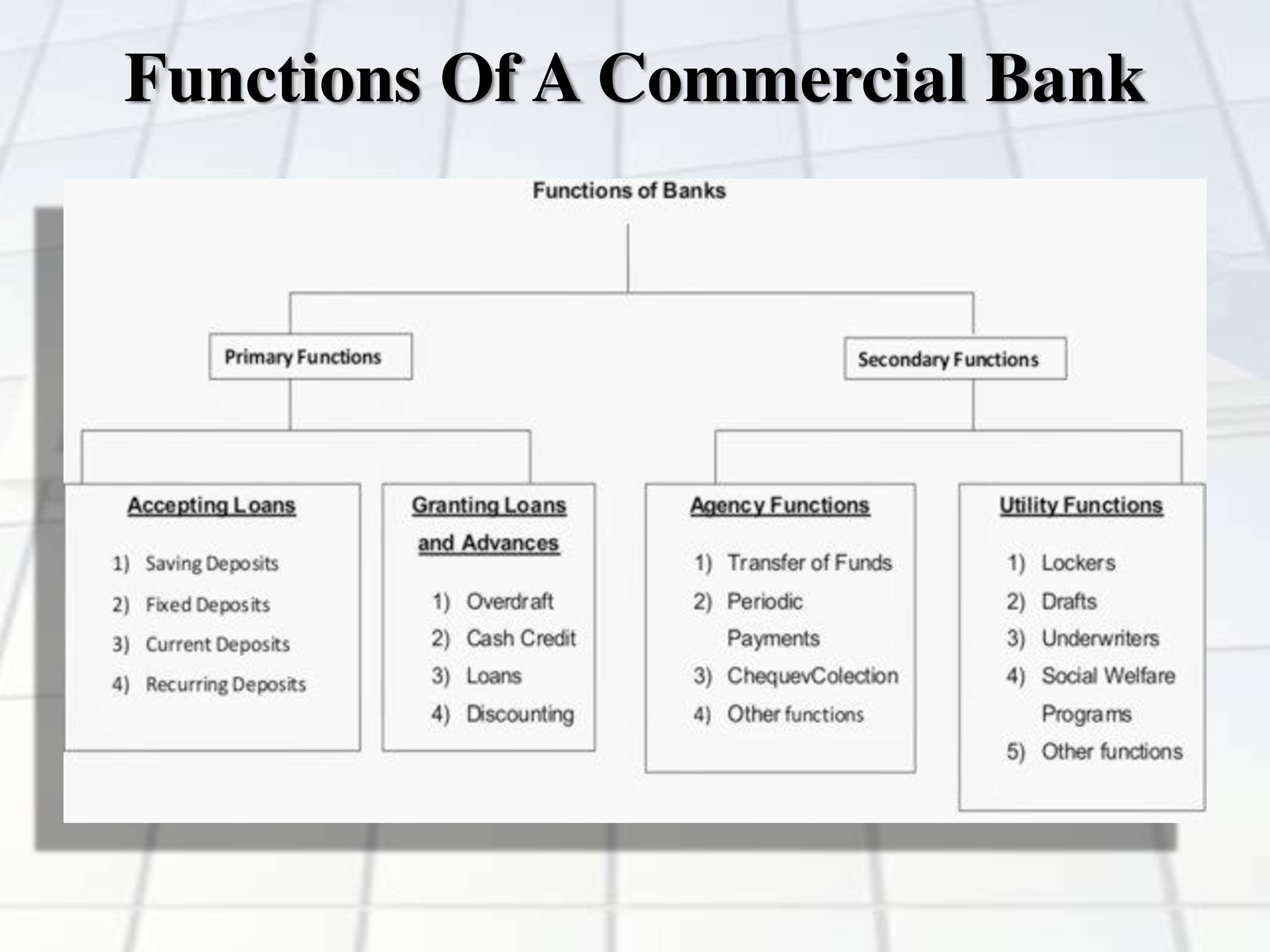

The banking sector is the most complicated yet important sector in any country, the more organized the sector is more functions are introduced in the sector. Apart from just managing the money saved by the account holder, a bank provides a lot more functions to the general public. Banking functions are categorized into two functions i.e. Primary function and Secondary functions.

Under Primary functions:

- Accepting Deposits:

The main function of a bank is to accept the deposits submitted by the customers. Here, deposit refers to the amount of money handed over by a customer to the bank. There are various types of deposit and each type of deposit amount is set according to the bank scheme present. Types of deposits:

- Saving

Deposit:

The deposit rate or the amount is low in this case and the rate of interest is

also low. You can also withdraw the amount but there is a limit allotted by the

bank for the withdrawal.

- Fixed Deposit: This term refers to the fixed amount which is given to the bank for a certain period of time by the customer. In this case, you cannot withdraw the fixed amount until the amount has matured, hence the name Fixed Deposit.

- Current Deposit: This term refers to the amount which is paid to the bank without any interest and the amount can be withdrawn at any point in time.

- Granting loans and advances:

Banks also help in providing financial aid to people in need therefore the functions of a bank include lending money to the public based on interest within a certain period of time. The loan is passed by the bank after a long verification process and after evaluating whether or not the customer will be able to pay back the entire amount with interest in the set timeline.

Under Secondary functions:

- Agency Functions: The role of a bank is to help the customer manage the finance by transferring funds, managing the cheques, collections and other services. This method showcases how a bank also acts as an agent to the customer while helping out with the finance.

- General Utility Functions: This term refers to the services like locker facilities, issue of drafts and credit cards, providing foreign exchange facilities and more are being provided by the bank. The bank also helps in providing social welfare programs for the weaker society.

These are the functions of a bank in India; banks also help in providing services which help in managing the money which you have invested in stock and in the stock exchange. With the help of Demat account, the bank will be able to help you manage all of the stocks you have invested in and will help you gain profit from the Demat account.