How payment system works in banks?

Banks payment system basically by lending money at higher rates than the cost of the money they lend. More specifically, banks charge interest on loans and interest payments on the debt securities they own and pay interest on deposits, certificates of deposit and short-term loans. Technically we call this difference as “spread” or net interest income. Besides, when that net interest income is divided by the assets that generate income from the bank. Usually, we consider this factor as the net interest margin.

Deposits:

The primary earning for banks is deposited money that accounts holders entrust to the bank. Generally, people call this “principal deposits,”. These are processes of the checking as well as savings accounts that belong to several account holders.

Generally, these accounts have a very short time to deposit. Although people usually keep accounts for years, the clients have the right to withdraw the total amount as many time as the customer wishes to. Many banks have the feature not to pay any interest on the balance of the current account and pay interest rates for savings accounts.

Wholesale Deposits:

Bank also have the payment system by wholesale deposits. In many ways, these wholesale funds are very similar to interbank CDs. We can consider that wholesale funds are good enough. In spite of that, investors have to go to a particular bank when it depends on this source of financing. While banks have all the rights to dismiss the branch-based deposit collection model as per their requirements. It is done with regards to wholesale financing.

Debt:

Generally, banks also raise their capital by issuing debt. Banks use debt more frequently to soften the ups and downs in their financing needs and will turn to sources such as repurchase agreements or the Federal Housing Loan Bank system to access short-term debt financing.

How online payment system works in banks?

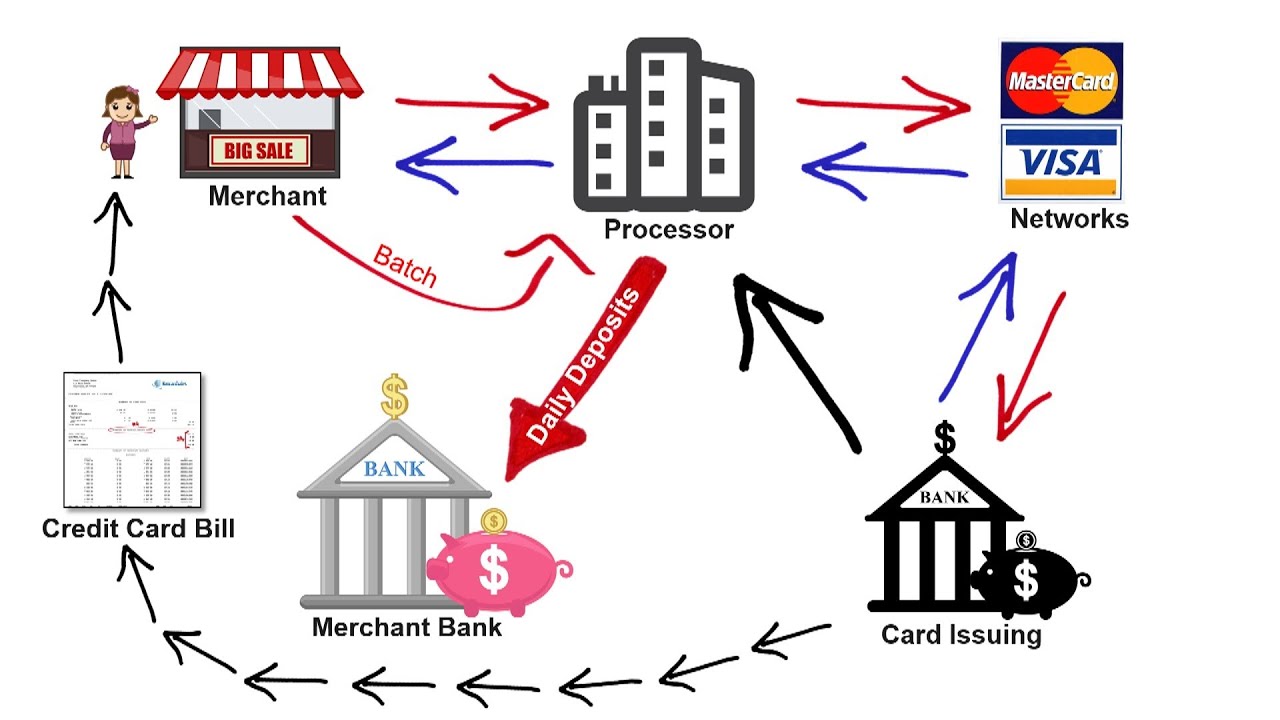

The payment gateway of a bank is used on a website or software to process the payment of a transaction. The steps of a transaction through a gateway are as follows:

- A customer will place an order on the website he visits by sending an order through a payment procedure or an equivalent pay now button.

- The client is sent to the gateway page to accept the details of the call transaction. This includes the credit card number, expiration date, CVV code, name, address.

- Then, the gateway sends this transaction information through the gateway and routes it to the issuing banks to request authentication and authorization.

- After the card type authentication is successful, the transaction is authorized or rejected by the issuing bank/card.

- The payment gateway takes this information and reports an authorization or rejects the merchant’s website or platform.

- Once approved, the portal and website work together to generate a receipt to send to the customer.

So we can see that, how the payment system works in the banking sector. Investors should also keep in mind that they should have profit on their investment while banks also have the purpose to make earning through investors as well as on providing the loan.