Types of Banks

The banking sector in India is very vast as the number of population is increasing every day. The Banking sector is a combination of various institutes supporting various economical segments across the country while managing the cash and credit of the citizens. RBI (Reserve Bank of India) looks after all the types of banks registered in India and regulates all the policies and conditions to be followed by the banking organisations.

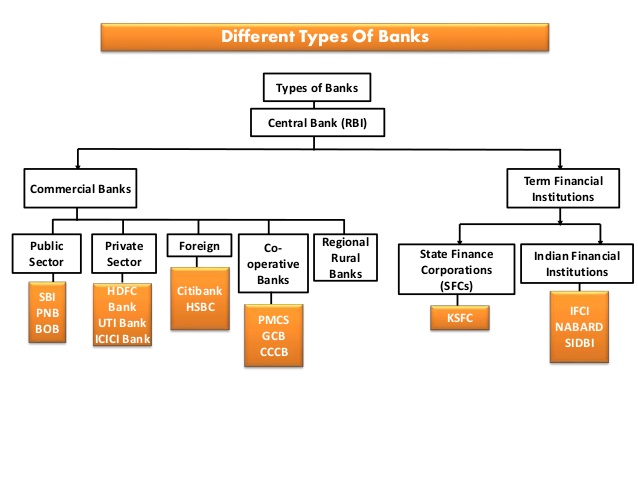

There are a total of four types of banks which are further divided into different types of banks. Here are the four types of banks present in India:

Commercial Banks:

Under the Banking Regulation Act 1949, commercial banks are designed according to a business model which helps in generating profits. It is further divided into four types of commercial banks:

- Public Banks:

This type of bank refers to the institutes where the government is the majority stakeholders of the bank. Banking institutes like SBI (one of the oldest and largest banks in India), Allahabad Bank, Bank Of India, Canara Bank and 16 other banks were regulated under RBI and most of the shares belong to the government bodies present in India.

- Private Banks:

In this type of Bank, most of the shares are owned by private businessmen. There are around 22 private banks in India out of which few of the famous banks are ICICI, HDFC, IDFC and many more.

- Foreign Banks:

Headquarter of these banks are present in a foreign country and only their branches are present across various states in India. HSBC, Bank of America and Citibank are few of the 46 foreign banks present in India.

- Regional banks:

Regional Banks are government-initiated commercial banks where credit and other services are provided to the weaker society, for farmers and the agriculture sector. This type of commercial bank helps the lower economy to function properly while purchasing the required equipment.

Small Finance Banks:

India is known for micro-industry and SMEs as there are multiple small business units working as a third party for various organisations. Small Finance Banks helps in providing financial aid to small businesses, farmers and micro-industry businesses in India.

Payment Banks:

Payment bank is a new model banking system introduced by the RBI. It helps in providing financial aid to the general public while restricting a certain deposit amount i.e. near Rs. 1 Lakh. Facilities like net banking, debit card services and other services are also provided by the bank.

Co-operative Banks:

Under the Cooperative societies Act 1912, the Cooperative banks follow no profit no loss banking system where the bank is operated by an elected committee. The main purpose of the cooperative banks is to provide financial aid to the business sector, to the self-employed, entrepreneurs and SMEs. The bank is further divided into two categories such as Urban-Cooperative Bank and State-cooperative bank where the financial supports provided to entrepreneurs form Urban and rural areas respectively.

These are the four main type of banking system followed in India. This system has helped in increasing the economic growth of the country as each bank type is focusing on providing financial support to various levels of society.