There are three general types of savings accounts: a savings bank account that will generate a small interest; a checking account, usually with a checkbook service without interest payments. However, banks can allow an overdraft in such accounts with prior approval. You can extract or close these accounts at any time.

Then there are term deposits also called fixed deposits, which have a higher interest rate but cannot be closed before the due date, without incurring a fine.

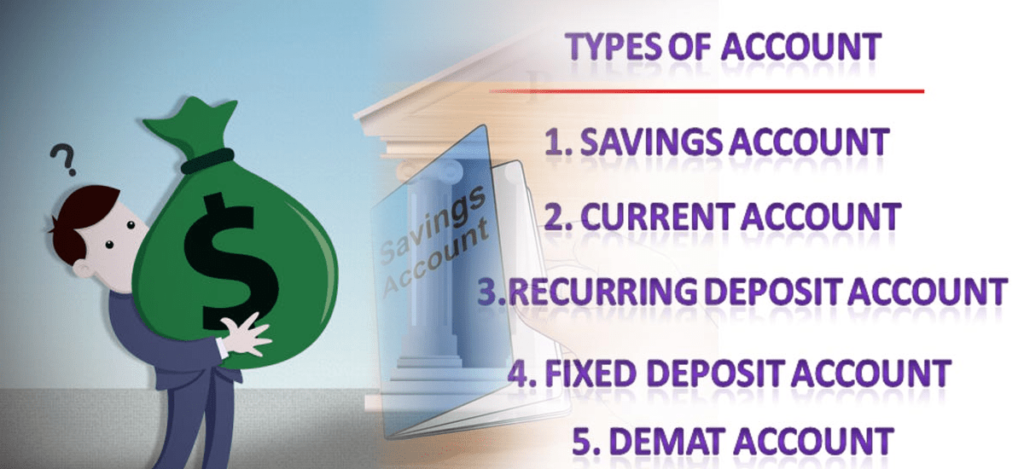

Types Of Bank Account:

Basically, there are four different types of bank accounts.

1. Current account: A current account is essential for business and commercial transactions. It is not for savings or investment purposes. You will not get any interest in this.

2. Savings account: A savings account is the most basic type of bank account. It is suitable for small savings and money for daily transactions. This account generates interest and, therefore, helps your money grow. It is suitable for all people, employees, and students.

3. Recurring deposit account: The RD account is opened by those who wish to save a certain amount of money regularly for a certain period of time and earn a higher interest rate.

4. Fixed deposit account: (also known as FD Account), a particular sum of money is deposited in a bank for a specific period of time. In the FD account, we can not withdraw this fixed amount before this certain period.

Bank Account On the Basis of Deposit and Advances

- Deposits:

- Savings accounts (demand deposits that accrue interest)

- Current accounts (interest-free demand deposits)

- Term deposits (contracted in a particular ROI for a particular period)

- Flexible accounts, which offer a combination of term deposits with either.

- Demat accounts and online business accounts to maintain values.

- Advances:

Individual loan accounts such as personal loans, housing loans, education loans, loans against term deposits, loans against shares, loans against insurance policies, overdraft against salary, overdraft against PF for employees, etc.

Commercial loans such as cash credit or term loans.

Loans can be offered against a guarantee (guaranteed advances) or clean advances (unsecured advances).

The following hybrid account is also offered by many banks now:

Multiple-option deposit account: a type of savings bank account in which the deposit that exceeds a particular limit is automatically transferred to the fixed deposit. On the other hand, in case there is no suitable fund available in our Savings Bank Account to honor a check we have issued, the required amount is automatically transferred from the Fixed Deposit to the Savings Bank Account. The balance amount continues as a Fixed Deposit and generates interest based on the existing interest rate. A higher interest rate can be obtained from a fixed deposit account than from a savings bank account.

Apart from this, a customer can make use of the shipping facilities by buying a cash draft up to the prescribed limit. Banks also offer investment products such as insurance, mutual fund products to their clients. Banks are also the point of purchase of IPOs or bond issues, agents for the issuance of dividends and interest guarantees, for specific products and companies.